| State | Karnataka |

| Exam | Second PUC Mid-Term Examination December 2021 |

| Subject | Accountancy |

| Download | Model Question Paper |

| Document Type |

Karnataka 2nd PUC Accountancy Mid Term Model Question Paper

Karnataka Model Question Paper of Second PU Mid-Term Accountancy Examination, December-2021

Karnataka 2nd PUC Accountancy Mid Term Model Questions

Section – A:

I. Answer any Eight questions, each question carries ONE mark. 8×1=8

1. The clauses of Partnership Deed can be altered with the consent of:

a. a) Two Partners b) Ten Partners

b. c) Twenty Partners d) All the Partners

2. The agreement between partners must be in writing. (State T/F)

3. If the amount brought by a new partner is more than his share in capital, the excess is known as……………

4. Give the formula for calculating Sacrifie Ratio.

5. Anu, Tanu and Manu are partners sharing profits in the ratio of 2:3:1. If Tanu retries, the New Profit Sharing Ratio between Anu and Manu will be a) 3:2 b) 5:3 c) 5:2 d) None of the above

6. How do you close the Executors Account?

7. Give an example for current asset.

8. Expand EPS.

9. Equity share holder are………………….

10. Write any one objective of financial statements.

Section – B:

II. Answer any Five questions, each question carries Two marks. 5×2=10

11. Define Partnership?

12. State any two methods for preparing the partners capital account.

13. Name any two methods for calculation of Interest on drawings.

13. State any two difference between dissolution of partnership and dissolution of partnership firm?

14. Give the journal entry for realisation expenses paid by the Firm?

15. Give the meaning of financial statements

16. Write any two benefits of financial statements.

17. List any two techniques of Financial Statement Analysis.

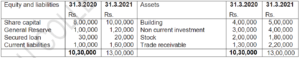

18. State any two uses of Financial Statement Analysis.

Section – C:

III.Answer any Four questions, each question carries Six marks. 4×6=24

19. Amar and Akbar started business in partnership on 01.04.2019 with a capital of ₹ 2,00,000 and ₹ 1,60,000 respectively agreeing to Share profits and losses in the ratio of 3:2. For the year ending 31.03.2020, they earned the profits of ₹ 72,000 before allowing:

i) Interest on capital at 5% p.a.

ii) Interest on drawings: Amar ₹ 1200 and Akbar ₹ 2,000.

iii) Yearly salary of Amar ₹ 12,000 and commission to Akbar ₹ 8000.

iv) Their drawings during the year: Amar ₹ 32,000 and Akbar ₹ 40,000.

Prepare Profit and Loss Appropriation Account.

20. Raja and Rani are partners in firm. Rani drawings for the year 2020-21 are given as under:

₹ 6,000 on 01.06.2020 , ₹ 9,000 on 30.09.2020, ₹ 3,000 on 30.11.2020,

₹ 2,000 on 01.01.2021, Calculate interest on Rani’s drawings at 8% p.a. for the year ending on 31.03.2021, under product method.

21 . Anita and Sunita are partners in a firm sharing profits in the ratio of 5:3. They admit Babita as a new partner for 1/7th share in the profit. The new profit sharing ratio will be 4 : 2 : 1. Calculate the sacrifice ratio of Anita and Sunita.

22. Asha Disha and Usha are partners sharing profits and losses in the ratio of 3:2:1.Disha retires from the firm. Asha and Usha decided to share future profits and losses in the ratio of 3:2. Calculate the gain ratio.

23. Rama, Shyama and Bhema are the partners sharing profit and losses in the ratio of 3:2:1, their capitals as on 1-04-2020 were ₹ 35,000, ₹ 45,000 and ₹ 30,000 respectively

Rama died on 31-12-2020 and the partnership deed provides the following:

1) Interest on capital @ 8% p.a

2) Rama’s salary ₹ 2,000 p.m

3) His share of profit up to the date of death based on previous year‘s profit. Firms profit for

2019-20 ₹ 24,000

4) His share of Goodwill ₹ 12,000

Ascertain the amount payable to Rama’s Executor by preparing Rama’s capital a/c

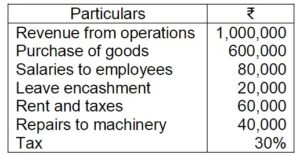

24. From the following information prepare statement of profit and loss for the year ending 31-03-2018 as per schedule III of Companies act, 2013

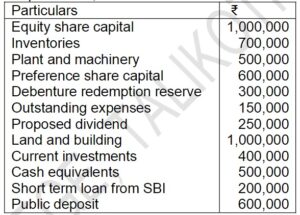

25. From the following information, prepare Balance sheet for the year ending 31/03/2020 as per schedule III of Companies act, 2013

Section – D:

IV. Answer any Four questions, each question carries Twelve marks. 4×12=48

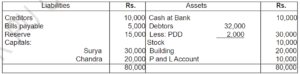

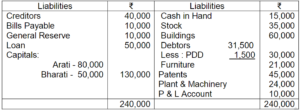

26. Surya and Chandra are partners sharing profits and losses in the ratio of 3 : 2. Their balance sheet as on 31.3.2020 was as follows:

Balance Sheet as on 31.03.2020

On 01.04.2018, they admit Akash into partnership on the following terms:

a) Akash should bring Rs. 25,000 as capital for 1/5th share in future profits.

b) He also bring The goodwill of Rs.15,000(As per AS.26)

c) PDD is reduced to Rs.1,000

d) Building is appreciated by 10% and stock is revalued at Rs.8,000.

Prepare Revaluation a/c, partners capital a/c and New balance sheet of firm.

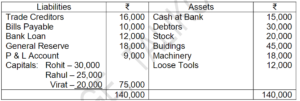

27. Arati and Bharati are partners in a firm sharing profit 3:2. Following is their Balance Sheet.

On 01.04.2020, Kirati is admitted into partnership for 1/6th share in future profit on the following terms: a. He should bring ₹ 25,000 as capital.

b. Goodwill of the firm is valued at ₹ 18,000 (As Per AS-26)

c. Stock is to be increased by 10%.

d. Provision for doubtful debts is increased to ₹ 2,500.

e. Capital accounts of partners are to is be adjusted in their new profit-sharing ratio 3:2:1, based on Kirati’s capital (Adjustments to be made in cash).

Prepare: i) Revaluation Account. ii) Partners’ Capital Accounts & iii) Balance sheet of the new firm.

28. Rohit, Rahul and Virat were in partnership sharing profits and losses in the proportion of 3:2: 1. On April 1, 2020, Rahul retires from the firm and on that date, Balance Sheet was as follows:

Balance Sheet as on 1-4-2020

The terms were:

(a) Goodwill of the firm was valued at ₹18,000 (As per AS-26)

(b) Stock to be brought to ₹ 19,000.

(c) Machinery and Loose Tools are to be valued at 10% less than their book value.

(d) Buildings are to be revalued at ₹ 50,000.

Prepare:

1. Revaluation Account

2. Partners’ Capital Accounts and

3. Balance Sheet of the firm after retirement of Virat.

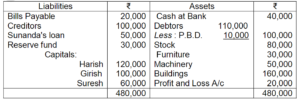

29. Harish, Girish and Suresh are partners sharing profits and losses in the proportion of 5:3:2.

Their Balance Sheet as on 31. 3. 2018 was as follows :

Balance Sheet as on 31. 3. 2018

On the above date the firm was dissolved. The following information is available:

a) The assets realised as follows: Debtors ₹ 90,000, Stock ₹ 75,000, Machinery ₹ 45,000, Buildings ₹ 200,000 and Furniture ₹ 28,000,

b) Creditors and Bills payable were paid@ 10% discount.

c) Dissolution expenses amounted to ₹ 4000.

Prepare:

i) Realisation Account, ii) Partners’ Capital Accounts and ,iii) Bank Account.

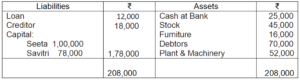

30. Seeta and Savitri sharing profits in the ratio of 3:1 and they agree upon dissolution. The Balance Sheet as on 31.03.2019 is as under:

Balance Sheet as on 31. 3. 2019

(1) Seeta took over plant and machinery at an agreed value of ₹.60,000.

(2) Stock and Furniture were sold for ₹..42,000 and ₹.13,900 respectively.

(3) Liabilities were paid in full.

(4) Realisation expenses were ₹1,500

(5) Debtors were taken over by Savitri at ₹.69,000.

Prepare : (i) Realisation Account (ii) Capital Accounts of Partners and (iii) Bank Account.

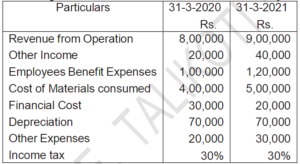

31. From the following information, prepare Commonsize Statement of profit and loss for the year ending 31st March 2020 and 31st March 2021 of Raju Co., Ltd

32. Prepare comparative balance sheet. From The following are the balance sheets of Samudra Ltd., as on 31.3.2020 d 31.3.2021

Section – E:

(Practical Oriented Questions)

V. Answer any Two questions, each question carries Five marks. 2×5=10.

33. How do you treat the followings in the absence of Partnership Deed?

a) Profit Sharing Ratio

b) Interest on Capital

c) Interest on Drawing

d) Interest on Advances from Partners

e) Partner Salary.

34. Write two Partners’ Capital Accounts under Fluctuating Capital System with 5 imaginary figures.

35. Write the pro-forma of a Balance Sheet of a Company with main heads only